10+ Section 179 Calculator

Before you file your taxes you may want to take time to understand how much you may be eligible for in Section 179. See an IRS fact sheet for Section 179 FS-2018-9 Sign the.

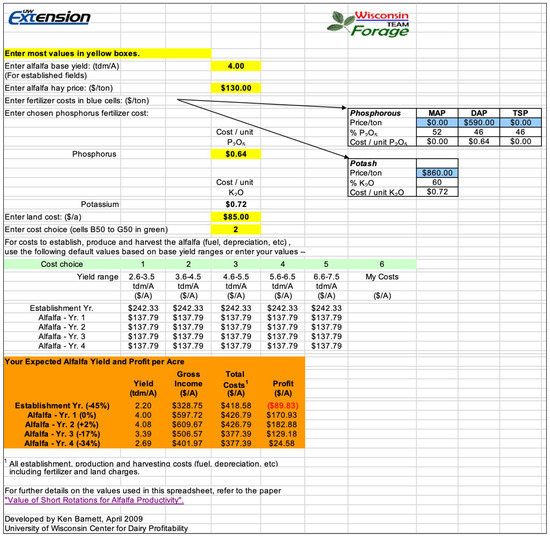

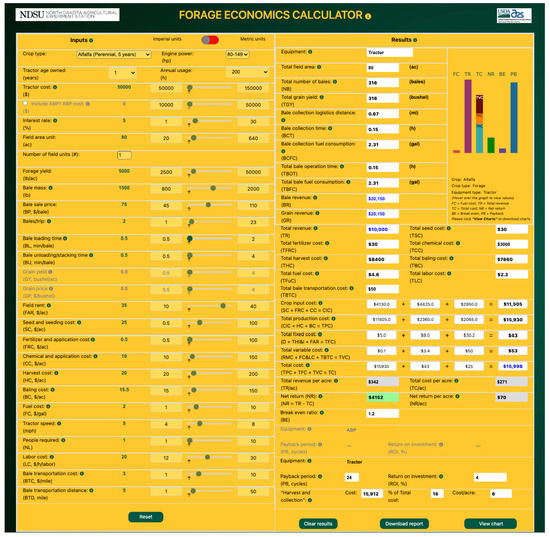

Agriculture Free Full Text Tools For Predicting Forage Growth In Rangelands And Economic Analyses Mdash A Systematic Review

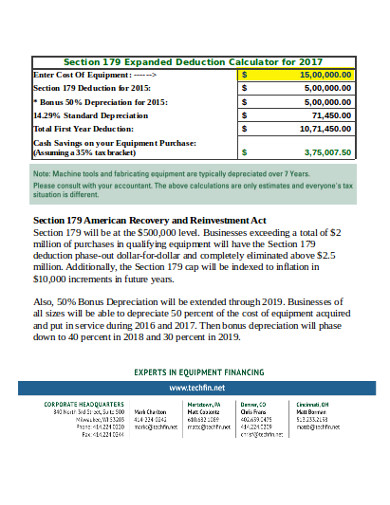

Web Instructions for Form 4562 2022 Instructions for Form 4562 - Introductory Material Future Developments Whats New Section 179 deduction dollar limits.

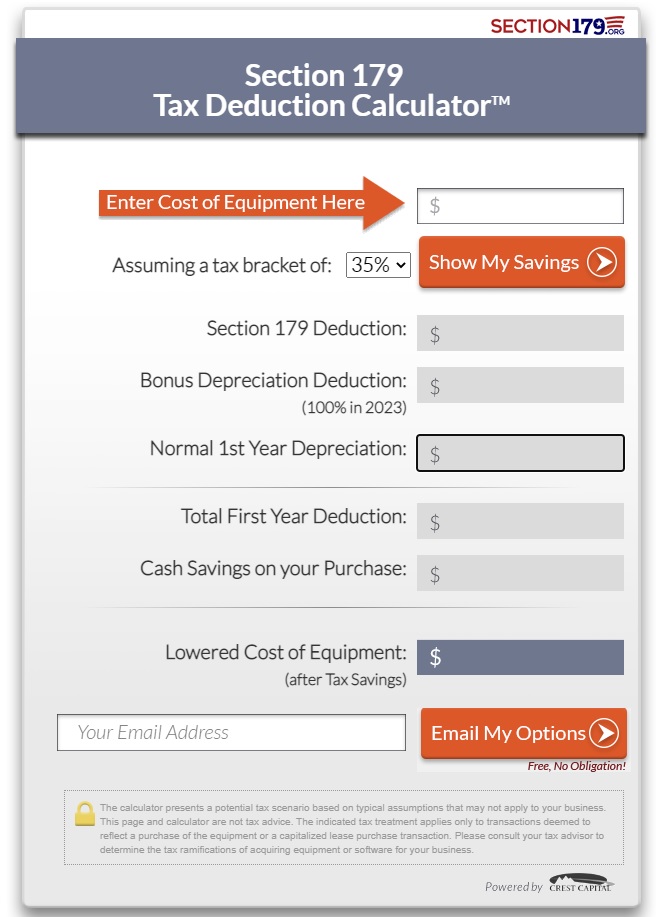

. Web Section 179 Deduction Calculator Software Features Section 179 Depreciation Software calculates Depreciation Expense that can be claimed under IRS Section 179. Section 179 of the IRS tax code gives businesses the. Web Section 179 Deduction Calculator.

Web Keep an Eye on Annual Limits. IRS Section 179 Deductions Highlights. Web Section 179 at a Glance for 2023 2023 Deduction Limit 1160000.

Normal Depreciation Normally you would write off a portion of the equipments cost each year spreading your tax benefits in small increments during that. Web Section 179 is an internal revenue code that allows businesses to deduct the price of specific qualifying equipment vehicles software and other assets also referred to as. Web Use Our Section 179 Deduction Calculator To Find Out.

Web Additionally we provide access to relevant IRS tax forms and helpful tools such as our free Section 179 Deduction Calculator which is currently updated for the 2023 tax year. Web See how much you can save with this easy-to-use calculator. What are my tax savings with Section 179 deduction.

Calculate your deduction with our Section 179 calculator and download the IRS Form. Web This article includes a Section 179 calculator for 2021. In 2023 the Section.

This deduction is good on new and used equipment financedpurchased and put into service by. Web 2023 Tax Incentives. For the tax year 2023 the deduction limit is 116 million with a phase-out.

Web Deduction Calculator How much money can Section 179 save you in 2023. Web The Section 179 deduction is huge in 2022 a full 1080000 thats up 30k from last year. How to take the Section 179 Deduction in 2023 is easy.

This calculator will help you estimate your tax savings. Combine this generous deduction with Crest Capitals Section 179 Qualified Financing. This easy-to-use calculator can help you estimate your tax savings for 2023.

Section 179 comes with annual deduction limits. Learn more Qualified Financing. Web Understanding the financial impact of Section 179 on your equipment costs is essential.

Tax provisions accelerate depreciation on qualifying equipment office furniture technology software and other business items. Most new and used equipment as well as some software qualify for the. 2021 is the best year to date for Section 179 allowances.

Web Scenario 1. Web The new Act raised the deduction limit to 1 million and the phase-out threshold to 25 million including annual adjustments for inflation. Web Calculating Your Section 179 Deduction.

My Bxp Gain Sheet R Rotmg

Section 179

Gcse 9 1 Maths Geometry And Measures Past Paper Questions Page 39 Of 41 Pi Academy

Equipment Financing And Section 179 Calculator For 2023

10 Depreciation Calculator Templates In Excel

Agriculture Free Full Text Tools For Predicting Forage Growth In Rangelands And Economic Analyses Mdash A Systematic Review

Use Section 179 Deduction To Save On Manufacturing Software Excellerant

Samsung Calculator 12 0 10 5 Arm64 V8a Arm V7a Android 10 Apk Download By Samsung Electronics Co Ltd Apkmirror

The Huge Potential Of The New Atlas Passive Tree Notes Added In The Sentinel League A Calculation R Pathofexile

2023 Irs Section 179 Calculator Packaging Equipment Financing

Creativesmallbizclub Etsy Australia

Deli 1700 Scientific Calculator Portable And Cute Student Calculator Pink

Section 179 Equipment Deductions Year End Tax Planning

![]()

2022 Section 179 Calculator Flexicon Corporation

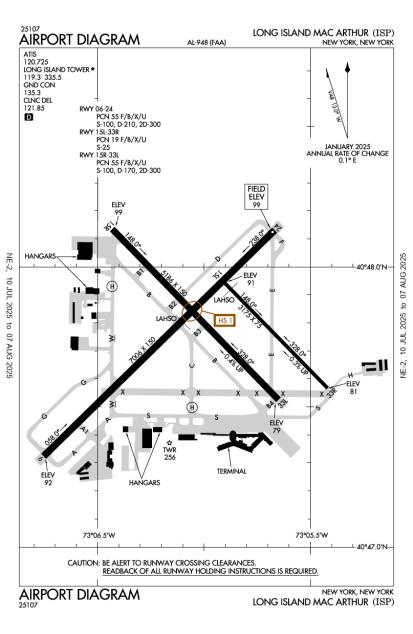

Long Island Mac Arthur Airport Kisp Aopa Airports

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Dba Consulting Blog